QUICK SUMMARY

XE Money Transfer is a globally recognized platform known for offering competitive exchange rates and user-friendly international money transfer services.

XE Money Transfer is a globally recognized platform known for offering competitive exchange rates and user-friendly international money transfer services.

👍 PROS:

- Supports money transfers in 100 currencies across over 130 countries.

- Offers brick-and-mortar pickup options for recipients.

- App is available in 11 languages.

- Absence of ongoing, commission, or transaction fees.

- Features competitive transfer rates, especially compared to banks.

- Expertise in foreign exchange rates due to specialization in world currency markets.

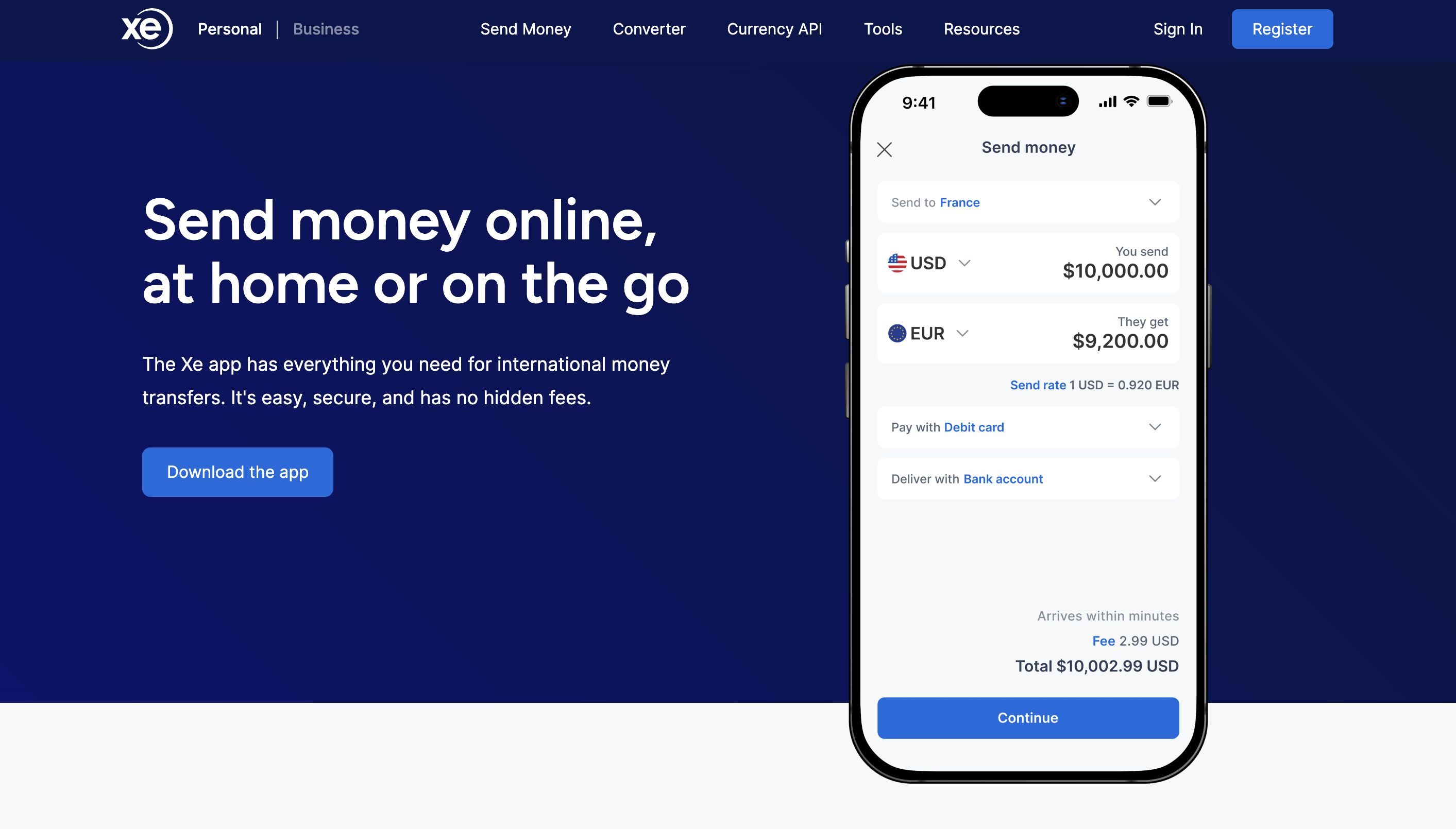

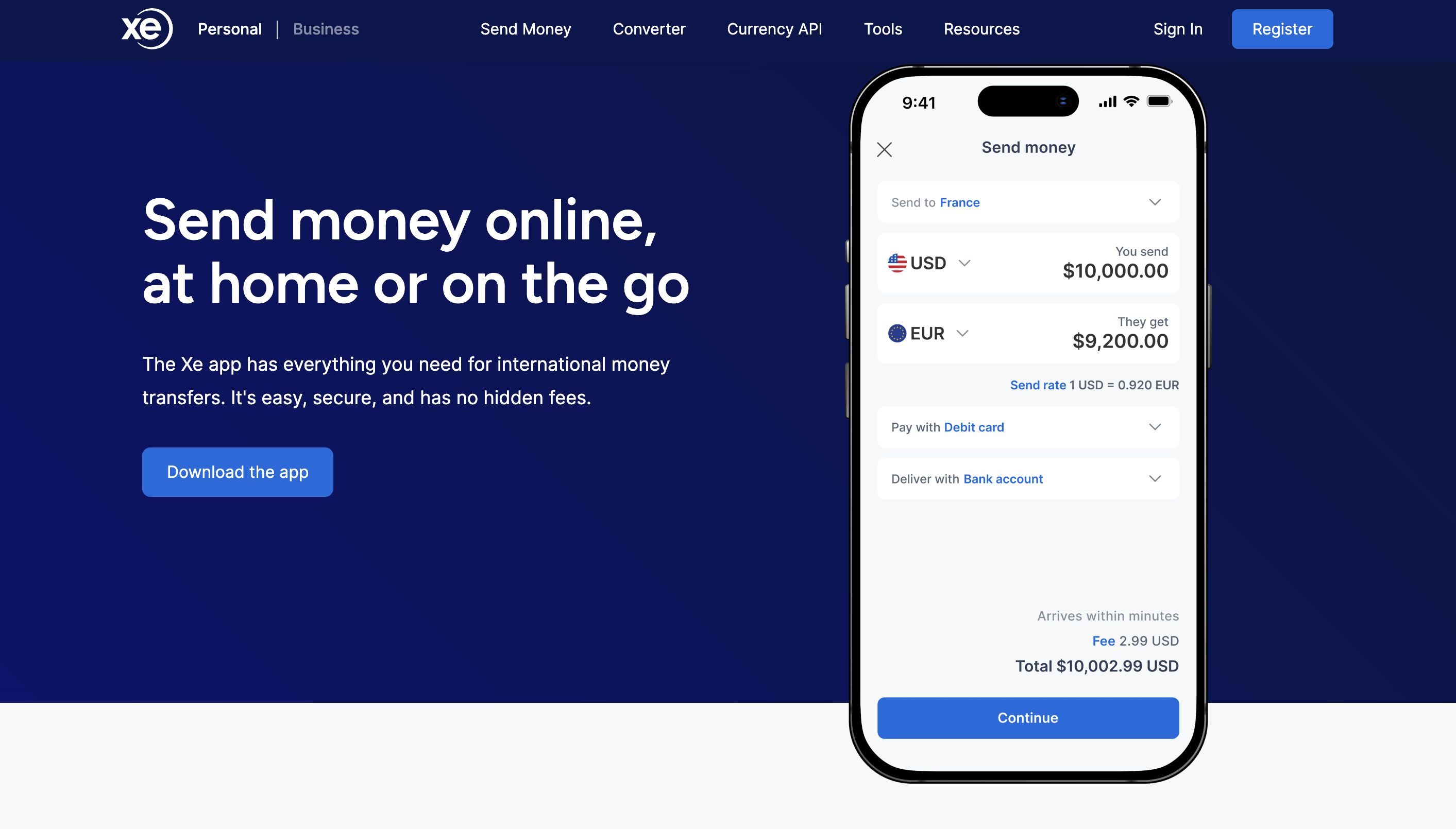

- User-friendly app design makes money transfers simple.

- Straightforward registration and initiation process on the app.

👎 CONS:

- Transfers are restricted from only 22 countries.

- Transfer fees apply.

- Displays mid-market exchange rates online, but charges a higher rate for international transfers.

- Card payments are limited to UK, Europe, Canada, the United States, New Zealand, and Australia.

XE Global Money Transfers: Quick and Secure

XE COMPANY BACKGROUND

XE is a leading global currency and foreign exchange service, forming an integral part of Euronet Worldwide (NASDAQ: EEFT), a renowned leader in currency exchange. Together, they stand as the third largest money transfer business globally, striving to deliver a simple, reliable, and user-friendly money transfer service.

Milestones:

• 1993: XE's journey began as Xenon Laboratories Incorporated, founded by high school buddies, Steven Dengler and Beric Farmer.

• 1995: From its humble origins in a house basement in Newmarket, Ontario, the company relocated to Toronto's financial district. This year also marked the launch of the Universal Currency Converter on their site, which quickly gained popularity to become the world's go-to currency site.

• 2000: Xenon Laboratories shifted its primary focus to currency and foreign exchange tools and services.

• 2001: The company was officially renamed XE.com Inc.

• 2002: XE trademarks, "Universal Currency Converter" and "XE," received registration in Canada, followed by registrations in the USA, EU, and other global locations.

• 2005: XE's headquarters moved to 1145 Nicholson Road, Newmarket, expanding to accommodate the growing needs of its user base.

• 2007: The site saw the introduction of dynamic currency charts and graphs and underwent a branding refresh with a new logo.

• 2009: XE launched its Currency App for iPhone, registering a million downloads within the first year, and soon after, becoming the world's preferred currency app.

• 2010: The Greater Toronto region recognized XE as a Top Employer, a recognition it would earn repeatedly in the subsequent years.

• 2012-2013: With the adoption of cloud computing in 2012, XE ensured agile and optimal user experiences. In 2013, the company celebrated its 20th anniversary as a top global site and introduced a responsive design for a seamless experience across devices.

• 2014: Addressing the requirements of corporate clients, XE launched XE Currency Data, which is now trusted by thousands of global organizations.

• 2015: XE joined the Euronet family, expanding its horizons even further in the currency domain.

• 2016: With a vision to be the world's trusted currency authority, XE had catered to over 280 million visitors by this year.

• 2017: Keeping up with technological trends, XE introduced an Alexa bot, offering an intuitive voice-based interaction mode for users.

• 2019: XE and HiFX united their forces, merging XE's currency expertise with HiFX's money transfer services to form a stronger entity.

WHO IS IT FOR?

XE caters to both individuals and businesses looking for reliable international money transfers without hidden costs. Whether you're supporting family overseas, traveling, or facilitating business transactions, XE has got you covered.

KEY FEATURES

Transfer Coverage:

XE supports transactions in nearly 100 currencies, reaching over 130 countries. If you reside in one of the 22 countries that XE caters to, you can easily register and begin sending money.

Transfer Duration:

Once XE receives your payment, the transfer process begins. Typically, it takes between 1 to 3 business days for the funds to reach your recipient, influenced by the chosen currency and destination country. Once completed, you'll receive a notification via email or text. If you're worried about any delays, you have the option to initiate a live chat to monitor your transfer.

Transfer Limits:

XE doesn't impose minimum limits for bank transfers, but your own bank might have daily, weekly, or monthly sending caps. Using the XE app for wire transfers? Ensure you're sending over $3,000 USD. There's also a ceiling for online transfers: from the U.S., it's $500,000 USD or its equivalent in another currency.

Cash Pickup:

Cash pickup enables Xe users from the UK, Europe, Canada, and the USA to transmit funds swiftly in tangible form to a recipient. As the one sending money, you decide on an amount to transfer. After payment for the transaction, XE provides you with a PIN number. The recipient can then collect the money from a chosen location using this PIN.

Facial Recognition for Verification:

XE might ask you to verify your identity using facial recognition. In certain instances, you'll need to upload an ID photo (like a driver's license or passport) and take a selfie using XE's facial recognition feature before the transaction proceeds.

MONEY TRANSFER OPTIONS

Wondering how to fund your transfers with XE? Here's a breakdown:

1. ACH Direct Debit: Automated Clearing House (ACH) payments take funds directly from your bank account, without requiring you to make a card transaction or write a check. Once you’ve authorized XE to take money from your account and signed the agreement, they’ll automatically deduct the funds from your account, without anything else required from you.

In addition to being good for automated payments (which are ideal for regular payments like bills), ACH payments won’t come with any added fees. However, ACH payments typically take longer to process, so this method might not be the best if you’re on a deadline.

2. Wire Transfer: Wire transfers, a widely recognized payment method, facilitate monetary movement between banks. They stand out as one of the quicker payment options; XE usually gets your funds within a day of initiating the transfer. While some other payment techniques might cap the transferable amount, wire transfers can handle substantial sums with ease.

However, it's important to note that, unlike ACH payments, there's a fee for wire transfers. This fee ensures swift fund transfers between financial entities.

3. Debit Card: For a fast transfer with XE, debit cards are an option. However, from the US, you can only send in US dollars. And while it's a speedy method, you might encounter additional processing fees. For first-timers, XE suggests a bank transfer over a card to meet their compliance checks. If you opt for a debit card for your initial transfer, anticipate an extra two-day wait while XE conducts added transaction reviews.

4. Credit Card: Similarly quick as debit cards, credit cards come with their set of considerations. Like with the debit card, you're restricted to sending US dollars from the US, with potential added processing fees, especially if your destination varies. Just as with debit cards, using a credit card for your inaugural transfer means XE will scrutinize it more closely. But, be cautious: funding with a credit card can be seen as a cash advance by your card provider, which could carry hefty fees and high-interest rates. And, XE doesn't accept prepaid cards.

FEES AND RATES

XE prides itself on transparency when it comes to fees and rates associated with money transfers. Here's what you need to know:

1. Send Fees:

Depending on the payment method you choose, the currency you’re dispatching, and the destination country, the fee for your money transfer may vary.

When initiating a transfer, whether through the XE app or online, you'll be provided with the exact send fee upfront.

This send fee is added to specific transfers, and it's always shown at the beginning and before you finalize the transfer.

Beyond the send fee, XE also earns when converting currencies. The rate at which your money is converted, termed the send rate, is clearly displayed throughout the transaction process. As XE uses live rates, the send rate may fluctuate before you finalize the transfer, but they commit to notifying you if any change occurs.

2. Payment Method Fees:

For those in certain countries, using a credit or debit card to fund the transfer attracts a fee, calculated as a percentage of the transfer amount.

If you use a credit card, be aware that your card provider might also levy a cash advance fee.

While card payments can be faster and ideal for urgent transfers, choosing to pay through bank or wire transfer doesn't incur a fee. However, transfers funded this way may take up to 4 business days to reach the recipient.

3. Third-party Fees:

XE always transfers the full amount you send without deductions. However, sometimes, intermediary banks or the recipient's bank might deduct a fee from the received amount.

XE doesn't profit from these third-party deductions. Moreover, they cannot predict or notify users in advance about these potential deductions as they are often dictated by local laws or regulations in the recipient's country.

If your recipient receives an amount less than anticipated, it might be due to these third-party fees.

In a nutshell, XE offers a transparent fee structure, making it easier for users to understand what they're being charged. Always review the detailed breakdown and choose the payment method that aligns best with your needs.

EASE OF USE

With a straightforward registration process and an intuitive website design, XE ensures users can effortlessly initiate and track their transfers. The mobile app further simplifies the process for on-the-go transactions.

SAFETY

XE takes security seriously. The platform uses top-notch encryption protocols to safeguard data. With decades of experience and positive user reviews, it's a trustworthy name in the money transfer industry.

VERDICT

XE Money Transfer, with its blend of competitive rates, no transfer fees, and a longstanding reputation, stands out as a premier choice for international money transfers. While the absence of a cash pickup might be a limitation for some, the overall benefits make it worth considering for both individual and business needs.

XE is a leading global currency and foreign exchange service, forming an integral part of Euronet Worldwide (NASDAQ: EEFT), a renowned leader in currency exchange. Together, they stand as the third largest money transfer business globally, striving to deliver a simple, reliable, and user-friendly money transfer service.

Milestones:

• 1993: XE's journey began as Xenon Laboratories Incorporated, founded by high school buddies, Steven Dengler and Beric Farmer.

• 1995: From its humble origins in a house basement in Newmarket, Ontario, the company relocated to Toronto's financial district. This year also marked the launch of the Universal Currency Converter on their site, which quickly gained popularity to become the world's go-to currency site.

• 2000: Xenon Laboratories shifted its primary focus to currency and foreign exchange tools and services.

• 2001: The company was officially renamed XE.com Inc.

• 2002: XE trademarks, "Universal Currency Converter" and "XE," received registration in Canada, followed by registrations in the USA, EU, and other global locations.

• 2005: XE's headquarters moved to 1145 Nicholson Road, Newmarket, expanding to accommodate the growing needs of its user base.

• 2007: The site saw the introduction of dynamic currency charts and graphs and underwent a branding refresh with a new logo.

• 2009: XE launched its Currency App for iPhone, registering a million downloads within the first year, and soon after, becoming the world's preferred currency app.

• 2010: The Greater Toronto region recognized XE as a Top Employer, a recognition it would earn repeatedly in the subsequent years.

• 2012-2013: With the adoption of cloud computing in 2012, XE ensured agile and optimal user experiences. In 2013, the company celebrated its 20th anniversary as a top global site and introduced a responsive design for a seamless experience across devices.

• 2014: Addressing the requirements of corporate clients, XE launched XE Currency Data, which is now trusted by thousands of global organizations.

• 2015: XE joined the Euronet family, expanding its horizons even further in the currency domain.

• 2016: With a vision to be the world's trusted currency authority, XE had catered to over 280 million visitors by this year.

• 2017: Keeping up with technological trends, XE introduced an Alexa bot, offering an intuitive voice-based interaction mode for users.

• 2019: XE and HiFX united their forces, merging XE's currency expertise with HiFX's money transfer services to form a stronger entity.

WHO IS IT FOR?

XE caters to both individuals and businesses looking for reliable international money transfers without hidden costs. Whether you're supporting family overseas, traveling, or facilitating business transactions, XE has got you covered.

KEY FEATURES

Transfer Coverage:

XE supports transactions in nearly 100 currencies, reaching over 130 countries. If you reside in one of the 22 countries that XE caters to, you can easily register and begin sending money.

Transfer Duration:

Once XE receives your payment, the transfer process begins. Typically, it takes between 1 to 3 business days for the funds to reach your recipient, influenced by the chosen currency and destination country. Once completed, you'll receive a notification via email or text. If you're worried about any delays, you have the option to initiate a live chat to monitor your transfer.

Transfer Limits:

XE doesn't impose minimum limits for bank transfers, but your own bank might have daily, weekly, or monthly sending caps. Using the XE app for wire transfers? Ensure you're sending over $3,000 USD. There's also a ceiling for online transfers: from the U.S., it's $500,000 USD or its equivalent in another currency.

Cash Pickup:

Cash pickup enables Xe users from the UK, Europe, Canada, and the USA to transmit funds swiftly in tangible form to a recipient. As the one sending money, you decide on an amount to transfer. After payment for the transaction, XE provides you with a PIN number. The recipient can then collect the money from a chosen location using this PIN.

Facial Recognition for Verification:

XE might ask you to verify your identity using facial recognition. In certain instances, you'll need to upload an ID photo (like a driver's license or passport) and take a selfie using XE's facial recognition feature before the transaction proceeds.

MONEY TRANSFER OPTIONS

Wondering how to fund your transfers with XE? Here's a breakdown:

1. ACH Direct Debit: Automated Clearing House (ACH) payments take funds directly from your bank account, without requiring you to make a card transaction or write a check. Once you’ve authorized XE to take money from your account and signed the agreement, they’ll automatically deduct the funds from your account, without anything else required from you.

In addition to being good for automated payments (which are ideal for regular payments like bills), ACH payments won’t come with any added fees. However, ACH payments typically take longer to process, so this method might not be the best if you’re on a deadline.

2. Wire Transfer: Wire transfers, a widely recognized payment method, facilitate monetary movement between banks. They stand out as one of the quicker payment options; XE usually gets your funds within a day of initiating the transfer. While some other payment techniques might cap the transferable amount, wire transfers can handle substantial sums with ease.

However, it's important to note that, unlike ACH payments, there's a fee for wire transfers. This fee ensures swift fund transfers between financial entities.

3. Debit Card: For a fast transfer with XE, debit cards are an option. However, from the US, you can only send in US dollars. And while it's a speedy method, you might encounter additional processing fees. For first-timers, XE suggests a bank transfer over a card to meet their compliance checks. If you opt for a debit card for your initial transfer, anticipate an extra two-day wait while XE conducts added transaction reviews.

4. Credit Card: Similarly quick as debit cards, credit cards come with their set of considerations. Like with the debit card, you're restricted to sending US dollars from the US, with potential added processing fees, especially if your destination varies. Just as with debit cards, using a credit card for your inaugural transfer means XE will scrutinize it more closely. But, be cautious: funding with a credit card can be seen as a cash advance by your card provider, which could carry hefty fees and high-interest rates. And, XE doesn't accept prepaid cards.

FEES AND RATES

XE prides itself on transparency when it comes to fees and rates associated with money transfers. Here's what you need to know:

1. Send Fees:

Depending on the payment method you choose, the currency you’re dispatching, and the destination country, the fee for your money transfer may vary.

When initiating a transfer, whether through the XE app or online, you'll be provided with the exact send fee upfront.

This send fee is added to specific transfers, and it's always shown at the beginning and before you finalize the transfer.

Beyond the send fee, XE also earns when converting currencies. The rate at which your money is converted, termed the send rate, is clearly displayed throughout the transaction process. As XE uses live rates, the send rate may fluctuate before you finalize the transfer, but they commit to notifying you if any change occurs.

2. Payment Method Fees:

For those in certain countries, using a credit or debit card to fund the transfer attracts a fee, calculated as a percentage of the transfer amount.

If you use a credit card, be aware that your card provider might also levy a cash advance fee.

While card payments can be faster and ideal for urgent transfers, choosing to pay through bank or wire transfer doesn't incur a fee. However, transfers funded this way may take up to 4 business days to reach the recipient.

3. Third-party Fees:

XE always transfers the full amount you send without deductions. However, sometimes, intermediary banks or the recipient's bank might deduct a fee from the received amount.

XE doesn't profit from these third-party deductions. Moreover, they cannot predict or notify users in advance about these potential deductions as they are often dictated by local laws or regulations in the recipient's country.

If your recipient receives an amount less than anticipated, it might be due to these third-party fees.

In a nutshell, XE offers a transparent fee structure, making it easier for users to understand what they're being charged. Always review the detailed breakdown and choose the payment method that aligns best with your needs.

EASE OF USE

With a straightforward registration process and an intuitive website design, XE ensures users can effortlessly initiate and track their transfers. The mobile app further simplifies the process for on-the-go transactions.

SAFETY

XE takes security seriously. The platform uses top-notch encryption protocols to safeguard data. With decades of experience and positive user reviews, it's a trustworthy name in the money transfer industry.

VERDICT

XE Money Transfer, with its blend of competitive rates, no transfer fees, and a longstanding reputation, stands out as a premier choice for international money transfers. While the absence of a cash pickup might be a limitation for some, the overall benefits make it worth considering for both individual and business needs.